- Stocks have been on fire since mid-October, but Bank of America says investors should take caution.

- BofA’s Jill Carey Hall told Insider in an interview about the biggest risks facing stocks today.

- Here are five ways investors can prepare for what could be a rocky end to 2021.

What can be harder for investors to stomach than suffering huge losses on their investments? Selling the top stocks in their portfolio, only to see them continue to charge higher day after day.

Though the S&P 500 has risen in 14 of 16 days since October 12, gaining 7% in that span, now is not the time to get complacent. That’s the view of Bank of America’s Jill Carey Hall, a US equity strategist who heads up the firm’s small- and mid-cap investing strategy.

Historically high stock valuations, ebullient market sentiment, and fading corporate optimism are all reasons why Bank of America’s five-factor model recommends that investors practice sound risk management, even as opportunities remain in pockets of the market.

“Our frameworks were still pointing to more downside than upside risks for equities,” Hall told Insider in a recent interview. “A lot of these risks that are out there, we didn’t feel had been adequately reflected in prices.”

Despite Hall's concerns, Bank of America isn't sounding any alarms just yet. The firm's year-end price target of 4,250 for the S&P 500 implies that stocks have nearly 9% downside, and its 2022 target of 4,600 implies stocks will be flat for the next 14 months.

But those targets are flexible, Hall said, adding that they can shift as data and sentiment do. In September, Bank of America raised its year-end S&P 500 target nearly 12% from 3,800 - which at the time was the lowest among Wall Street banks, according to Seeking Alpha.

Elevated valuations, euphoria, and eroding sentiment

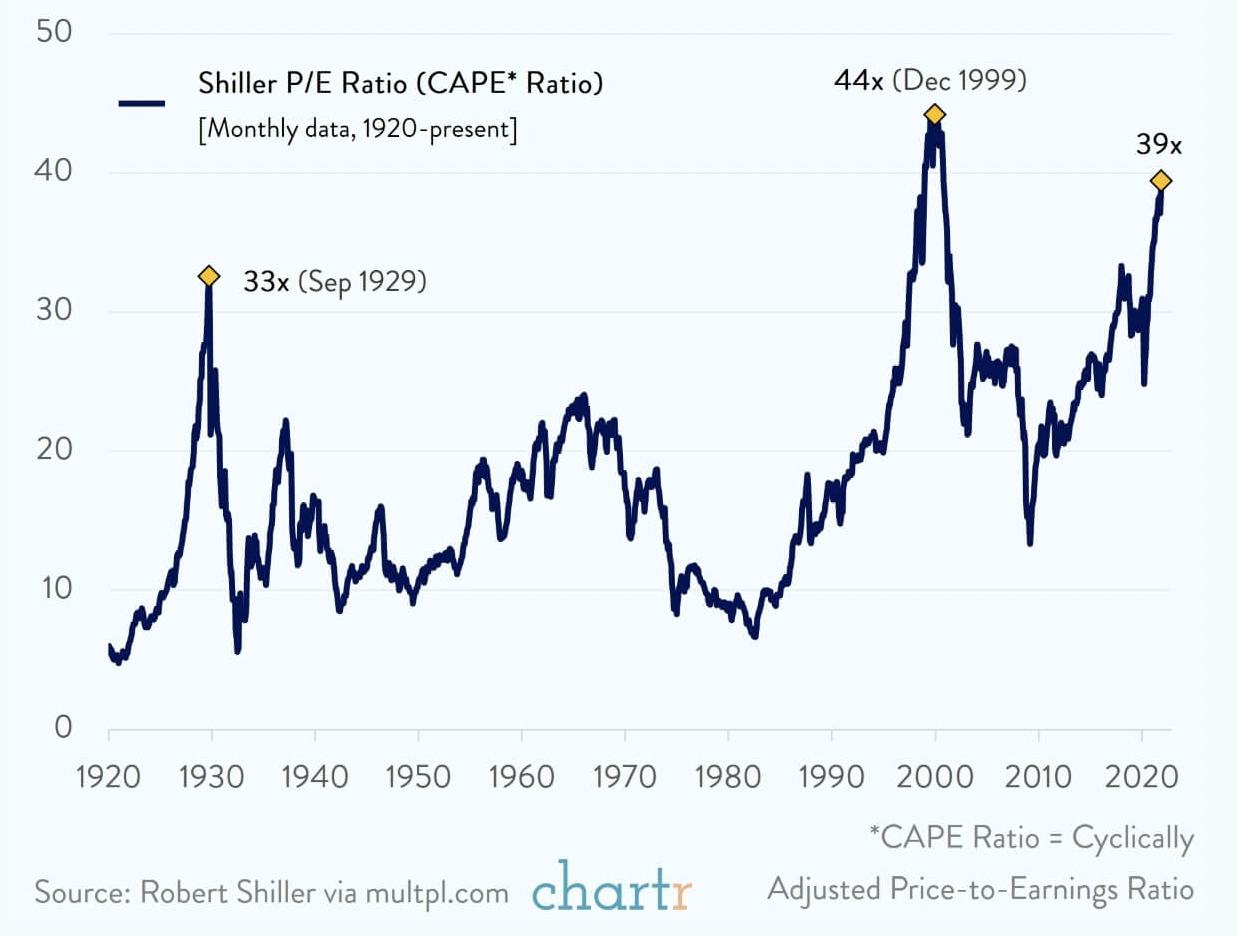

Comparisons of today's stock market valuations with those of the tech bubble of 2000 shouldn't be dismissed as sensationalism. Though stocks are still trading "well below" the frothy valuations of 22 years ago, Hall said that "very elevated" equity valuations on a forward-price-to-earnings basis are a legitimate reason to be wary of stocks.

However, that doesn't mean a stock market crash is coming anytime soon. Valuation isn't a very accurate predictor of near-term returns, Hall said, adding that it's a useful tool for predicting long-term outcomes. That may be a warning sign for forward-thinking investors.

"Based on today's elevated valuation multiples, our model is actually suggesting that price returns over the next decade could actually be slightly negative on an annualized basis," Hall said.

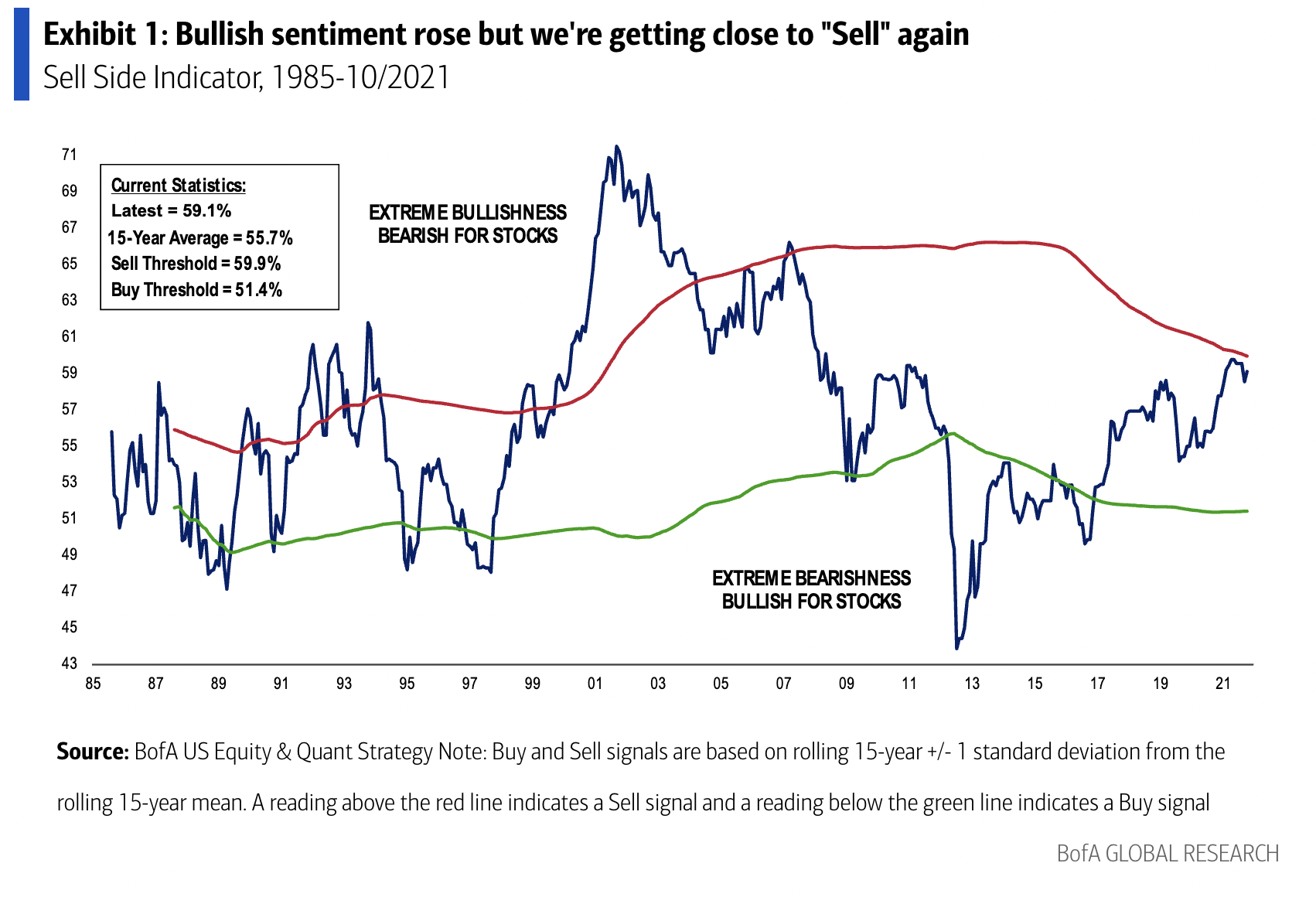

Another reason not to dive head-first into stocks is that so many others are. Investor sentiment is as bullish as it's been in a decade, according to Bank of America's Sell-Side Indicator. The gauge is close to triggering a sell signal for the first time since right before the financial crisis, and Hall called it one of the most accurate market timing indicators historically.

The main area of exuberance in markets, in Hall's view, is large-cap technology names, which she said has been a "crowded" trade for a while. As economic growth slowed in the 2010s, investors piled into stocks like Apple (AAPL), Amazon (AMZN), Facebook (FB), and Google (GOOGL) that could generate so-called "secular growth" without a roaring economy.

Bank of America is far from alone in its belief that positive sentiment is negative news for stocks.

Ryan Detrick, the chief market strategist for LPL Financial, wrote in a November 1 note that bullish sentiment is currently one of the five biggest risks to stocks.

"We do not see evidence that sentiment is near extreme levels yet, or that the technical trends do not support a bullish view," Detrick wrote. "But if the next few months do bring equity gains, sentiment may become a bigger risk."

While overly optimistic investor sentiment can be bad news, downcast corporate sentiment - which is currently at its lowest levels since Q2 2020, according to Bank of America - can't be anything but bad news.

In fact, sentiment tends to be a leading indicator for earnings by one quarter, wrote Savita Subramanian, Hall's colleague and BofA's head of US equity strategy and quantitative strategy, in a recent note.

Hall named three additional risks for stocks: weakening corporate guidance, supply-chain issues, and inflation, as measured by rising wages and prices for goods.

Where to invest despite risks

Despite the issues facing the market, Hall said total return prospects for stocks are "still favorable" from an asset allocation perspective, given the lack of viable options for investors. That's partially because bond yields are negative thanks to high inflation, Hall said.

Bank of America favors five factors in this environment, Hall said: Stocks with inflation-protection yields, domestic-based companies, high-quality names, small-caps, and value stocks.

To find equities with strong cash flows and rising dividends, look in the Energy sector, Hall said, adding that their exposure to inputs like oil makes energy stocks a strong inflation play. US-based firms are preferable to multinational corporations, in Bank of America's view, especially if taxes don't rise dramatically next year.

Quality stocks, or those that have healthy balance sheets and reliable cash flows, tend to outperform their lower-quality counterparts when economic growth slows, as it's set to in 2022. But growth will still be strong, which is why Hall is bullish on economically sensitive small-cap and value stocks that will disproportionately benefit as the economic expansion rolls on.